Together with Our

Shareholders and Investors

The Nippon Soda Group discloses information in a timely and appropriate manner in order to enhance management transparency and to meet the expectations of and honor the trust that we receive from our stakeholders. We strive to hold constructive dialogue with the aim of realizing continuous growth and improving corporate value.

- Maintaining constructive dialogue with our shareholders and investors is essential to achieving continuous growth and improving corporate value over a medium- to long-term period. As such, the president and responsible directors and executive officers engage in dialogue as necessary.

- Information is disclosed in a timely manner, with importance placed on fairness and accuracy, in accordance with the Timely Disclosure Rules of the Tokyo Stock Exchange.

- Requests and comments received from our shareholders and investors through dialogue are communicated at Board of Directors meetings as necessary so that we can reflect them in management.

Communication

Dialogue with Our Shareholders

The Nippon Soda Group holds an ordinary general meeting of shareholders in June every year, viewing it as an important opportunity to engage in direct conversation with shareholders.

We strive to deliver the notice of convocation of the General Meeting of Shareholders at an early date so that our shareholders may acquire a good understanding of the issues that will be reported and the matters for resolution at the shareholders’ meeting. We also provide pre-delivery disclosure of information on Nippon Soda’s website and at the Tokyo Stock Exchange website, before the notice of convocation of the General Meeting of Shareholders is sent out.

Voting rights may be exercised not only in writing but also via the Internet.

We create our business reports (annual report and interim report) twice a year in order to inform our shareholders of the Company’s current situation. In addition, Japanese version of these business reports are posted on the Nippon Soda website to make them widely available to those other than our shareholders.

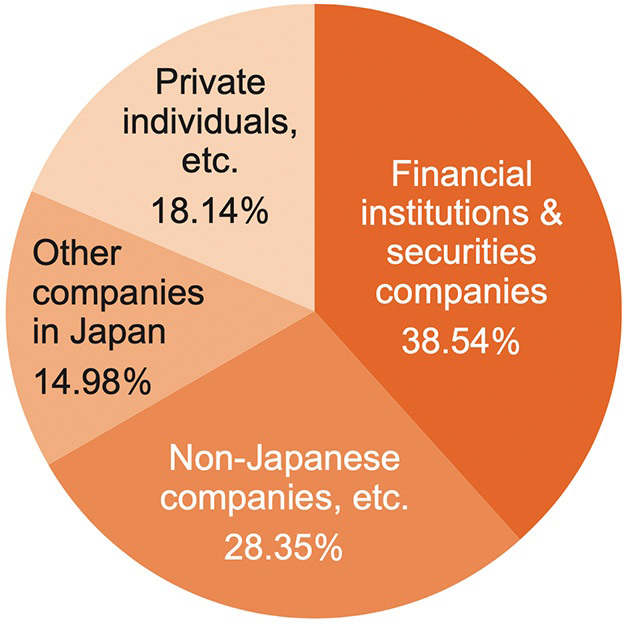

- Share distributuion by type of shareholder (As of March 31, 2024)

Total number of authorized shares: 96,000,000 shares

Total number of issued shares: 28,747,667 shares

Number of shareholders: 24,127

- Notes: Figures have been rounded to the nearest second decimal point

- Treasury shares are included in “Private individuals, etc.”

- * On May 31, 2024, we cancelled 353,800 shares of treasury stock (common shares).

- Moreover, we also conducted a two-for-one share split of our common shares with an effective date of October 1, 2024.

- As a result, our total number of authorized shares stands at 192,000,000, and the total number of issued shares at 56,787,734.

Dialogue with Investors and Analysts

The Nippon Soda Group actively engages in dialogue with investors and analysts to help deepen their understanding of business details and our business performance.

We respond to requests for individual interviews from domestic institutional investors and securities analysts, and hold financial results briefings and business overview briefings twice a year. At these briefings, the representative director and president, responsible directors, and executive officers explain the performance of the Nippon Soda Group and the growth scenario. Furthermore, in addition to hosting live broadcasts of our briefings to enable more people to attend, we also post videos of the briefings, briefing materials (in Japanese and English), and English scripts on our website.

For institutional investors outside Japan, we ensure timely disclosure of our financial results summaries and create briefing materials in English.

The comments and proposals received through dialogue with investors and securities analysts are logged into our in-house database and shared with directors and executive officers as appropriate. In addition, details of this dialogue are regularly reported to the Board of Directors. In this way, the comments and proposals are reflected in the management of our Group.

In FY 2024, we engaged in dialogue with a total of 342 institutional investors and securities analysts. The main themes were recent performance, future growth strategies, progress with the medium-term business plan, capital policies, shareholder returns policy, and sustainability initiatives. Summaries of the Q&A sessions from our financial results briefings and business overview briefings can be found on our website.

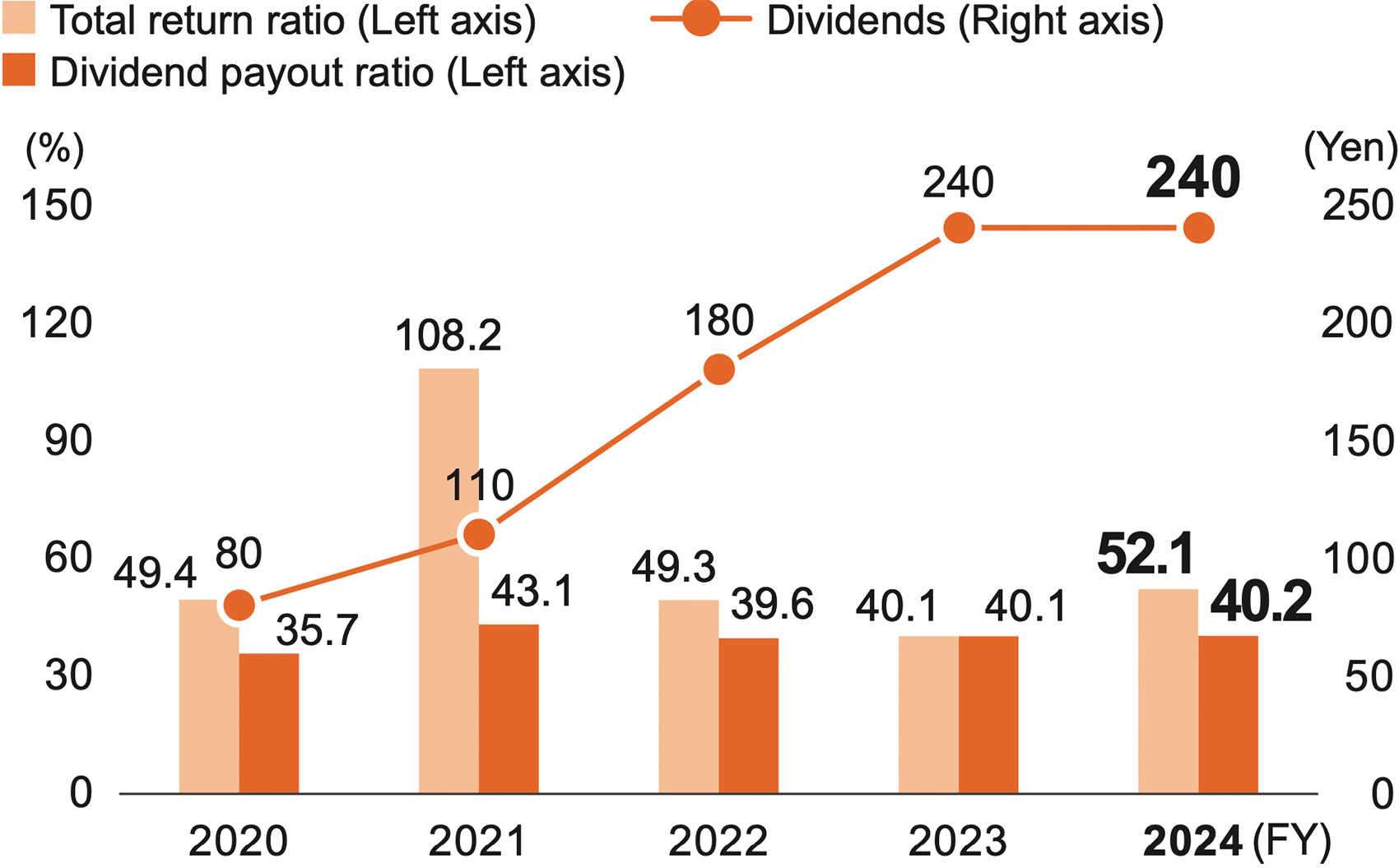

Basic Policy on Shareholder Returns

The Nippon Soda Group makes decisions on profit distribution based on revenue trends and by comprehensively considering such issues as providing stable dividends, enhancing shareholders’ equity, and improving our financial standing. Our basic policy is to provide dividends twice a year, at the middle and end of the fiscal year.

Retained earnings are used for improving corporate value, such as by advancing the development and achieving early market launches of new products, and for allotment to growth investment such as M&As and business partnerships, as well as for maintenance and upgrade investments to support stable and continuous growth.

As for return of profits to our shareholders, we will continue to provide stable dividends with the target of realizing a total payout ratio of 50% based on the shareholders’ return policy stated in the medium-term business plan Brilliance through Chemistry Stage II for FY 2024 to FY 2026. We will also adopt a flexible stance on repurchasing treasury shares as a shareholder return measure to complement dividends.

Shareholder returns