Long-Term Vision /

Medium-Term Business Plan(Overview)

Nippon Soda Group

Long-Term Vision

“Brilliance through Chemistry 2030”

FY 2021/3–FY 2030/3

Vision of Nippon Soda Group

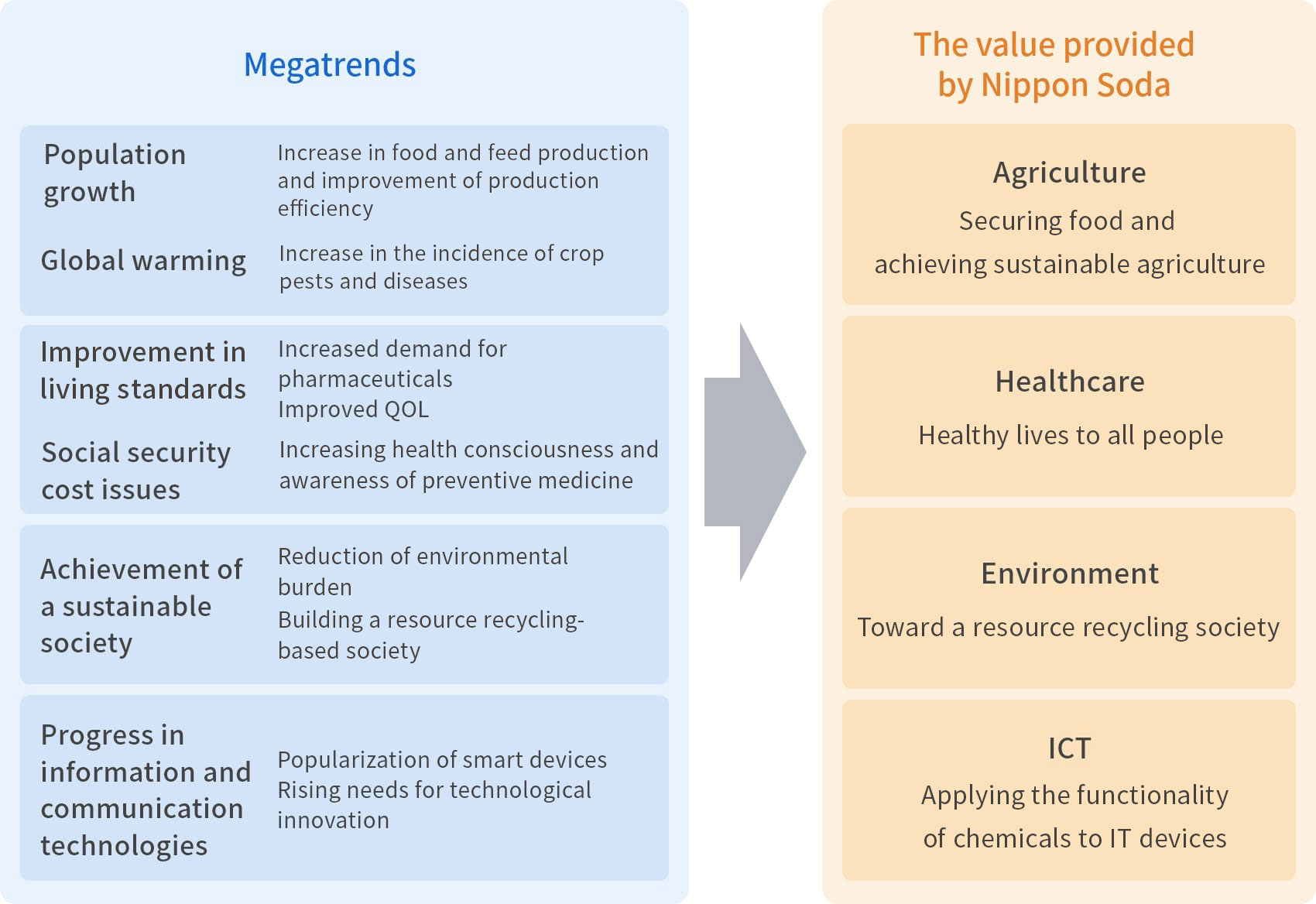

Since its establishment in 1920, Nippon Soda has provided new value to society through chemistry and contributed to the development of society.

The Group will supports people's everyday lives by delivering a range of chemical products and services to the agricultural, healthcare, environmental, and ICT fields.

Mission of the Nippon Soda Group

Create New Value through the Power of Chemistry and Increase Corporate Value by Contributing to Society.

Long-Term Vision “Brilliance through Chemistry 2030”

- While accelerating the expansion of our high-value-added businesses and the liquidation of unprofitable businesses, we will promote thorough management streamlining and reform our business portfolio to be resilient toward changes in the business environment and to produce stable earnings.

- While balancing growth investment and shareholder returns, we aim to increase capital efficiency.

Our Vision for 10 Years Ahead KPIs for FY 2030/3 (Partially Revised in May 2025 )

We will aim for management that prioritizes capital efficiency as we strive to improve our corporate value.

| ROS (Operating Profit on Sales) |

10% or more (FY 2020/3: 5.6%) |

|---|---|

| ROA (Operating Profit on Assets) |

7% or more (FY 2020/3: 3.8%) |

| ROE (Return on Equity) |

10% or more (FY 2020/3: 4.8%) ↑ Re-revised from “8% or more” formulated and announced in February 2020 and “12%” revised in May 2023. |

Basic Strategy

Through growth investment that emphasizes ROI and thorough structural reforms,

“Transition to a Highly Efficient Business Structure—Raise Our Profit Efficiency to More than Double the Current Level”

| Enhancement of Cost Competitiveness and Efficiency |

|

|---|---|

| Expansion of Overseas Businesses |

|

| Promotion of New Product Development and Entry into New Businesses |

|

Current Progress and Future Initiatives of

Long-Term Vision

Current Progress of the First Five Years (FY 2021/3 to FY 2025/3)

Overview

- Profit margins improved through expansion of high-value-added businesses and business portfolio transformation, significantly exceeding the numerical targets set in Medium-Term Business Plan Stage I.

- Proactive growth investments in products and businesses to enhance cash flow generation capability progressed as planned.

- Achieved the dividend payout ratio target of 40% in Medium-Term Business Plan Stage I and the total return ratio target of 50% or more in Stage II.

Key Achievements

| Expansion of High-Value-Added Products |

|

|---|---|

| Growth Investment |

|

| Business Liquidation |

|

| Improvement of Capital Efficiency and Shareholder Returns |

|

Unexpected Factors

- Implemented shipment adjustments due to forward buying of agrochemicals caused by logistics disruptions after the COVID-19 pandemic, which led to increased distribution inventory

- Recorded extraordinary losses due to the Noto Peninsula Earthquake

- Terminated production at Mizushima Plant (due to difficulties in raw material procurement).

Current Progress of KPIs (FY 2025/3)

| ROS (Operating Profit on Sales) |

10.4% (FY 2020/3: 5.6%) |

|---|---|

| ROA (Operating Profit on Assets) |

5.6% (FY 2020/3: 3.8%) |

| ROE (Return on Equity) |

8.0% (FY 2020/3: 4.8%) |

Initiatives for the Next Five Years (FY 2026/3 to FY 2030/3)

Basic Policy

- Transform into a structure that is resilient to changes in the business environment and generates stable earnings through expansion of high-value-added businesses and thorough management efficiency.

- Aim to create new value through new businesses.

- Enhance capital efficiency through growth investments and shareholder returns to improve corporate value and shareholder value.

- Introduce a new capital policy, aiming for early realization of PBR exceeding 1.0.

| Expansion of High-Value-Added Business |

Further expansion of growth driver products

|

|---|---|

| Enhancement of Management Foundation |

Measures against declining working-age population:DX and human capital investment ¥10.0 billion

|

| Improvement of Capital Efficiency and Shareholder Returns |

Reform of balance sheet

|

Capital Allocation (5-year total for the next five years)

Cash In

- Operating cash flow (before R&D expense deduction)

- Reduction of inventories

- Improvement of inventory turnover ratio (aim for 4.0 times by FY 2030/3)

- Liquidation of cross-shareholdings

- Aim for net asset ratio of less than 10% at an early stage and less than 6% by FY 2030/3

- Financing

- Enhance financial leverage through interest-bearing debt financing

Cash Out

- Growth investments: ¥30.0 billion

- Expansion of growth driver businesses

- New business investments (Organic EL light-emitting material "TADF")

- R&D expenses: ¥40.0 billion

- Creation of new businesses (Organic EL business, Animal Health business)

- Flexible allocation

- Startup investments, business alliances, and M&As that contribute to corporate value enhancement

- Enhancement of management foundation: ¥10.0 billion

- Establish a system by FY 2030/3 that can respond to a 10% reduction in personnel as a measure against declining working-age population

- Maintenance and renewal investments: ¥30.0 billion

- Strengthening the foundation of existing businesses, building optimal production systems

- Shareholder returns

- Introduction of progressive dividend policy

- Treasury share acquisitions

- (Flexibly implement treasury share acquisitions considering optimization of capital structure and stock price conditions)

Target of

Current Medium-Term

Business Plan:

Brilliance through Chemistry Stage Ⅱ

(FY 2024/3–FY 2026/3)

Position as “core stage for reform into a highly efficient business structure” and execute various measures to enhance corporate value.

Basic Objectives

- Enhance corporate value through expansion of high-value-added businesses, and structural reform and growth investments that focus on asset efficiency.

- Establish and sophisticate core technologies by promoting research technology strategies, and promote the creation of new businesses.

Capital Policy

- Proactively implement policies that focus on the balance between growth investments and shareholder returns while considering financial soundness.

| Growth Investment |

Implement investments in products and businesses which increase our cash flow generation capability.

|

|---|---|

| Increase Capital Efficiency |

Focus on investment efficiency and appropriately control the balance sheet.

|

| Shareholder Return Policy |

|

Numerical Targets

- Despite the materialization of factors for increased costs, such as rising raw material and fuel prices, we will establish increased profitability in Stage Ⅰ, which will lead to increased revenue in Stage Ⅲ, by promoting the continuous improvement of efficiency in each department.

| Medium-Term Business Plan | Long-Term Vision KPI | |||||

|---|---|---|---|---|---|---|

| Stage Ⅰ | Stage Ⅱ | |||||

| FY 2023/3 Results |

FY 2024/3 Results |

FY 2025/3 Results |

FY 2026/3 Targets |

FY 2030/3 Targets |

||

| Net Profit(Billions of yen) | 16.69 | 16.61 | 15.01 | 17.0 | ||

| Capital Investment(Billions of yen) | 13.26 (34.08/3 years) |

7.48 | 10.31 | 40.0 /3 years |

||

| Shareholder Returns(Billions of yen) | Dividends*(yen) | 120 | 120 | 140 | ||

| Dividend Ratio(%) | 40.1% | 40.2% | 51.4% | |||

| Purchase of Treasury Shares(Billions of yen) |

0 | 2.0 | 0 | |||

| Total Return Ratio(%) | 40.1% | 52.1% | 51.4% | 50% or more | ||

| ROE(%) | 10.3% | 9.3% | 8.0% | 10% | 10%* | |

| ROS(%) | 9.8% | 9.0% | 10.4% | 10% or more | ||

| ROA*(%) | 6.8% | 5.1% | 5.6% | 7% or more | ||

- *Dividends are calculated based on the post-share split basis following the share split conducted on October 1, 2024.

- *ROE was re-revised in May 2025 from "8% or more" announced in February 2020 and "12%" revised in May 2023.

- *Operating profit on Assets (ROA): Operating profit ÷ Total assets

Action Plan

| Chemical Materials |

|

|---|---|

| Agri Business |

|

| Other Businesses |

|

| R&D・Production Technology |

|

| Initiatives for Environment and Enhancement of Human Capital |

|