Corporate Governance

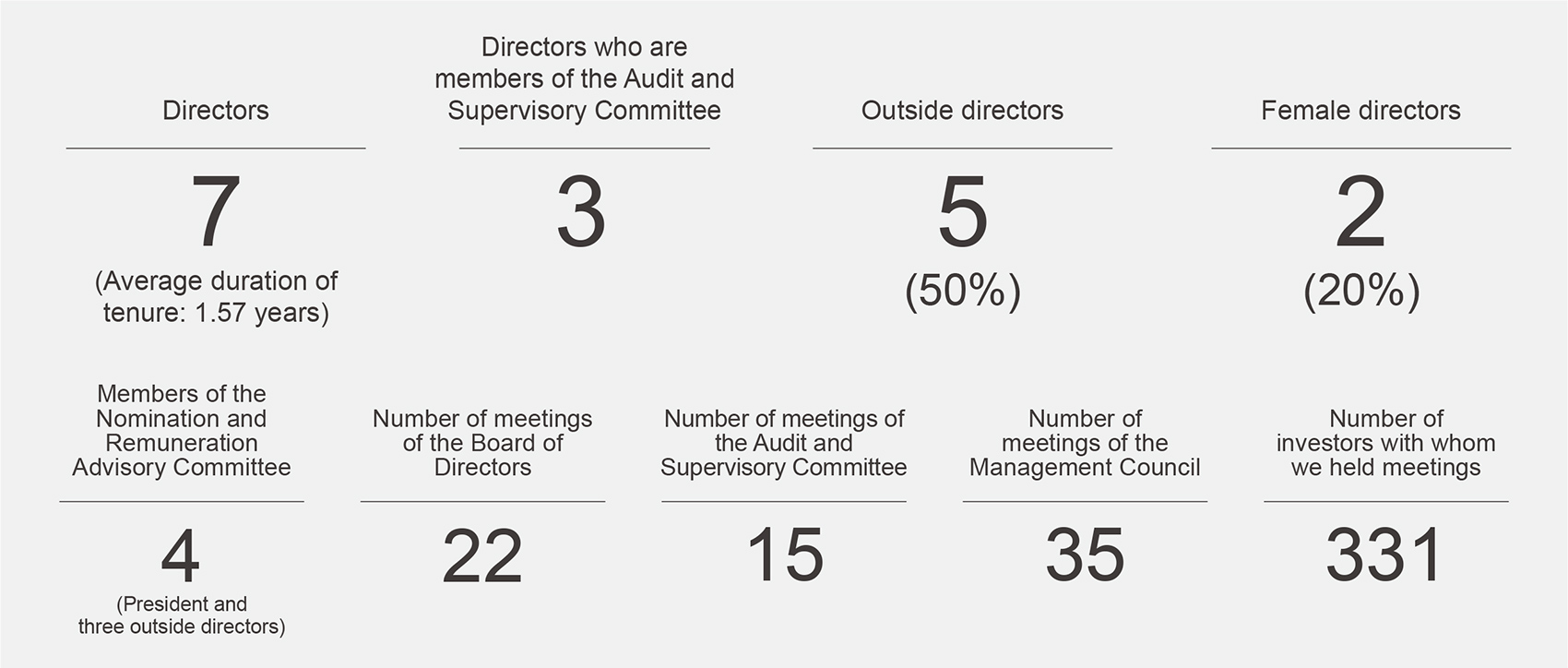

Corporate Governance Highlights

Nippon Soda places primary importance on sound and transparent business management in compliance with laws and ordinances. Our management philosophy is to contribute to social development by providing superior products through chemistry, to meet expectations from stakeholders, including customers, shareholders, investors, business partners, employees and local communities, and to promote environmentally conscious business practices and activities.

Under this philosophy, we are committed to growing into a technology-oriented group that develops high- added-value products by making best use of its proprietary technologies and expands its business with a global point of view centered on chemistry.

We recognize that the enhancement of corporate governance is an important management issue for realizing our management philosophy and responding quickly and appropriately to rapid changes in the business environment.

A History of Strengthening Governance

Aiming to Strengthen Governance

- Strengthen management supervision and improve operational agility

- Increase the diversity of the Board of Directors

- Enhance management transparency and fairness

- Strictly comply with laws and ordinances and corporate ethics

| FY 2013 | Established CSR Administration Meeting Abolished the executive retirement benefit system |

|---|---|

| FY 2014 | Introduced an executive officer system (number of directors reduced from 14 to 7) Nominated 1 outside director |

| FY 2016 |

Nominated 2 outside directors (increased by 1 person, including 1 woman) Started effectiveness assessment of the Board of Directors |

| FY 2017 |

Reviewed the executive remuneration system (introduced a performance-based stock remuneration plan, board benefit trust (BBT)) |

| FY 2018 | Established Remuneration Advisory Committee |

| FY 2019 | Established Nomination and Remuneration Advisory Committee Utilized external organization for effectiveness assessment of the Board of Directors |

| FY 2021 | Transitioned to a company with an audit and supervisory committee |

| FY 2023 | Reviewed the executive remuneration system (introduced a transfer restricted share remuneration system (RS)) |

Corporate Governance System

The Nippon Soda Group is fully aware of its fiduciary responsibility in accordance with Japan’s Corporate Governance Code and is committed to enhancing its corporate governance structure.

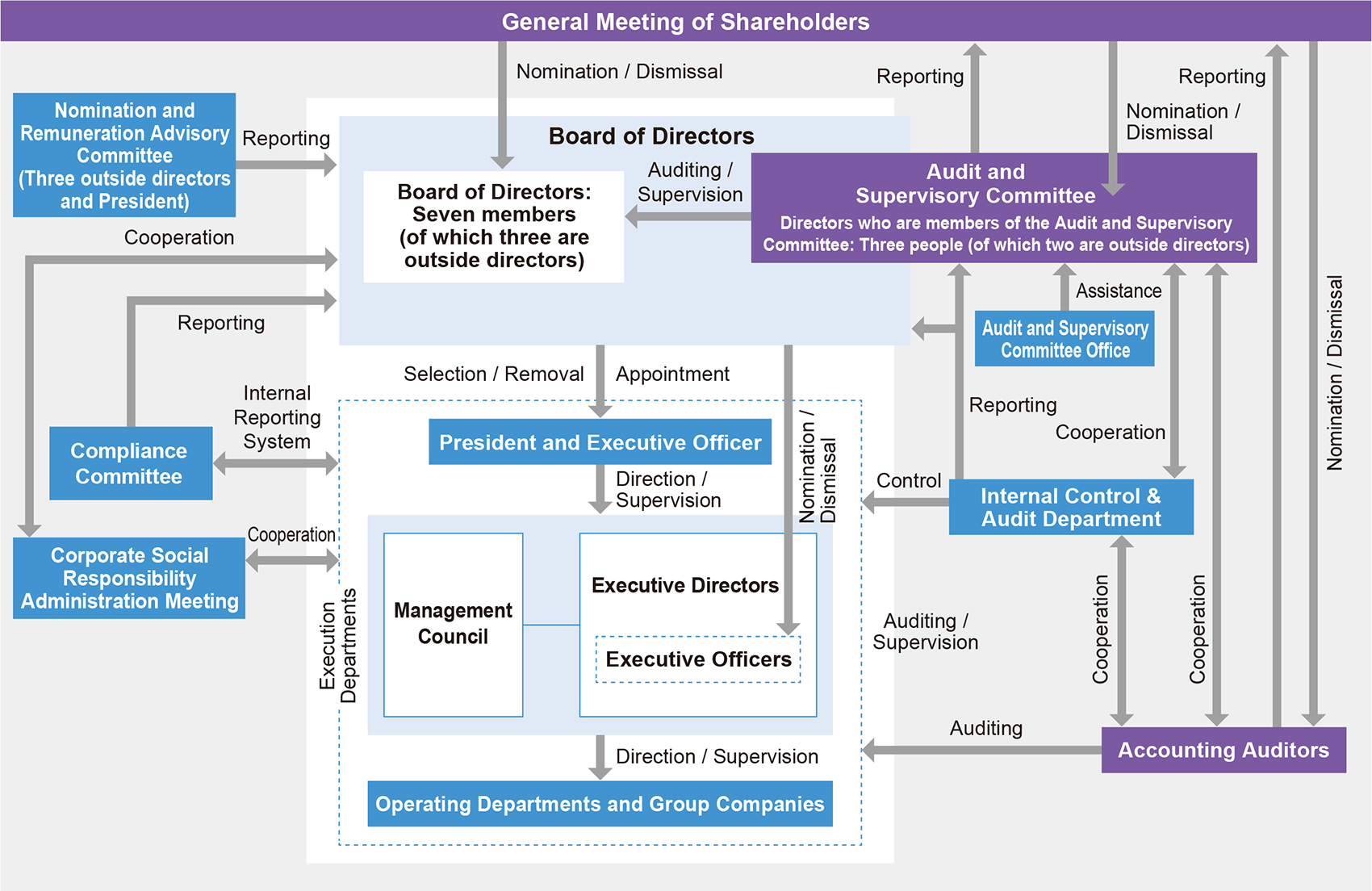

Corporate Governance Structure

General Meeting of Shareholders

The Nippon Soda Group holds an ordinary general meeting of shareholders in June every year, viewing it as an important opportunity to engage in direct dialogue with our shareholders. We deliver the notice of convocation of the General Meeting of Shareholders at an early date so that our shareholders may acquire a good understanding of the issues that will be reported and the matters for resolution at the shareholders’ meeting.

We also provide pre-delivery disclosure of information on Nippon Soda’s website and at the Tokyo Stock Exchange website, before the notice of convocation of the General Meeting of Shareholders is sent out. Voting rights may be exercised not only in writing but also via the Internet.

Board of Directors

The Board of Directors is responsible for making important management decisions (based on clear standards, such as amounts above a certain level) as stipulated by laws and ordinances, the Articles of Incorporation, and the Board of Directors Rules, as well as supervising the execution of each director’s duties. The tenure of directors (excluding directors who are members of the Audit and Supervisory Committee) is set at one year to ensure that they are able to respond quickly to changes in the environment and to clarify their management and operational responsibilities.

Audit and Supervisory Committee

Two of the three directors who are members of the Audit and Supervisory Committee are outside directors. Directors who are also members of the Audit and Supervisory Committee not only attend Management Council meetings, but also inspect important documents (approval requests) and receive explanations of important matters directly from the relevant directors, executive officers, department, or subsidiary in an effort to gain an accurate understanding of corporate information throughout the Group while also monitoring and verifying whether or not related departments are handling and responding to the situation and whether or not internal controls are being legally and appropriately executed. In addition to this, they work closely with the accounting auditors to ensure the reliability of our financial statements, in particular, by receiving regular reports from them and attending some of their on-site audits.

Nomination and Remuneration Advisory Committee

In order to enhance the fairness and objectivity of executive personnel (including successor development plans) and executive remuneration, we have established an independent and effective Nomination and Remuneration Advisory Committee consisting of three outside directors and the President. The Committee advises and makes recommendations to the Board of Directors on executive personnel and remuneration.

Management Council

In accordance with the Management Committee Operation Rules, Nippon Soda’s Management Council, consisting of the President, directors who concurrently hold the position of executive officer, and others requested to attend by the President, generally meets once a week (with auditors). It discusses important issues involving business execution other than issues that must be discussed by the Board of Directors, in order to make quick decisions on issues related to business execution.

Compliance Committee

Nippon Soda operates a Compliance Committee, which is chaired by the director in charge of compliance, with legal departments serving as the secretariat, with the aim of ensuring thorough corporate conduct based on compliance with laws and ordinances, and corporate ethics throughout the Group. The Compliance Committee comprises executive officers as members, and we have appointed a staff member in charge of compliance at each department, worksite and Group company.

Corporate Social Responsibility Administration Meeting

Chaired by the president and executive officer, the Corporate Social Responsibility Administration Meeting serves as the chief companywide decision-making body to promote CSR activities, including Responsible Care (RC). Held twice a year, the meeting is attended by all Nippon Soda directors, executive officers, plant managers, and officers from main domestic Group companies. Through these meetings, management sets CSR targets, assesses results, and revises the targets as necessary to ensure continuous improvement in line with the PDCA cycle.

Director Nomination Policy

Decisions on the nomination of director candidates and the selection and dismissal of senior management are made by resolution of the Board of Directors based on the advice and recommendations of the Nomination and Remuneration Advisory Committee. Also, candidates for the position of directors who are members of the Audit and Supervisory Committee are determined by the Board of Directors after obtaining approval from the Audit and Supervisory Committee.

To ensure that they are suitable for their responsibilities, candidates for directors and senior management are selected in accordance with the following criteria:

- (1) Extensive business experience

- (2) Excellent managerial sense

- (3) Leadership, drive and planning skills

- (4) Proper character and insight

- (5) Healthy in body and mind

Candidates for outside directors are nominated in accordance with the requirements of the Companies Act and the Tokyo Stock Exchange, and include those with expertise and extensive experience who can be expected to provide constructive and candid views and comments on the Company’s management. In the event of any impropriety or significant violation of relevant laws, regulations or the Articles of Incorporation in the performance of duties by senior management, or any other reason that makes it difficult for them to properly perform their duties, they shall be removed from their position.

Outside Directors

Nippon Soda has five highly independent outside directors (including two directors who are also members of the Audit and Supervisory Committee) in an effort to enhance the ability of the Board of Directors to contribute to the Company’s sustainable growth and to increase medium- and long-term corporate value. Regarding independent outside directors, in accordance with the requirements of the Companies Act and the Tokyo Stock Exchange regarding independence, the Company nominates individuals who are unlikely to have conflicts of interest with general shareholders and who are able to ensure objectivity and rationality in the Company’s decision-making and contribute to increasing corporate value. Specifically, none of the following must apply to the person:

- (1)A person who does business with the Company or its subsidiaries as a principal customer or an executive thereof

- (2)A primary business partner of the Company or its subsidiaries or an executor of such business

- (3)A consultant, certified public accountant, lawyer or other professional who has received a large amount of money or other assets from the Company or its subsidiaries in addition to directors’ remuneration

- (4)A person who has fallen into any of the above categories (1) to (3) in the past year

- (5)The spouse or a relative within the second degree of kinship of the following persons:

- 1.A person who falls under (1) to (4) on the left

- 2.A person who is, or has been in the past one year, an executive of the Company or its subsidiaries

- 3.A person who is currently, or has been in the past one year, a non-executive director of the Company or a subsidiary of the Company

Skills Matrix

At the Nippon Soda Group, the mission we have set in our long-term vision (FY 2021–FY 2030) is to “Create new value through the power of chemistry and increase corporate value by contributing to society.” To achieve this mission, and to ensure appropriate and quick decision-making on important management matters such as basic strategies, capital policies, and sustainability management, as well as supervision of directors’ execution of duties, we have identified the skills required of the Board of Directors as below.

These required skills will be revised as necessary in line with changes in external environments and internal conditions.

| Name | Directors | Specialist expertise and experience | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Gender | Position | Director tenure |

Corporate management |

Finance/ accounting |

Business strategy/ portfolio |

R&D/ production technology |

Internatio- nality |

ESG/ sustainability |

Legal affairs/ risk management |

|

| Eiji Aga | Male | Director, President (Representative Director) |

4 years | ● | ● | ● | ||||

| Atsuo Watanabe | Male | Director, Executive Managing Officer |

2 years | ● | ● | |||||

| Osamu Sasabe | Male | Director, Executive Managing Officer |

3 years | ● | ● | |||||

| Osamu Shimizu | Male | Director, Executive officer |

2 years | ● | ● | ● | ||||

|

Yuko Watase

Outside

Independent

|

Female | Director | 2 years | ● | ● | ● | ||||

|

Takayoshi Meiga

Outside

Independent

|

Male | Director | 1 years | ● | ● | ● | ||||

|

Tatsufumi Sakai

Outside

Independent

|

Male | Director | New appointment |

● | ● | ● | ||||

| Nobuyuki Hori | Male | Director, Audit and Supervisory Committee member (Full-time) |

2 years | ● | ● | |||||

|

Yoko Waki

Outside

Independent

|

Female | Director, Audit and Supervisory Committee member |

4 years | ● | ||||||

|

Hayato Yoshida

Outside

Independent

|

Male | Director, Audit and Supervisory Committee member |

2 years | ● | ● | |||||

- * There have been 13 Board of Directors’ meetings since Takayoshi Meiga became directors of the Company on June 29, 2023

Reasons for Appointment of Outside Directors

| Name | Attendance at meetings of the Board of Directors and the Audit and Supervisory Committee |

Reason for nomination | |

|---|---|---|---|

| Board of Directors (17 meetings) |

Audit and Supervisory Committee (15 meetings) |

||

| Yuko Watase | 17 times | ― | We believe that Yuko Watase can use her specialist expertise and international experience in accounting audits as a certified public accountant, as well as her long-term involvement in work related to domestic and cross-border M&As and business portfolio strategies, to help reinforce the Company’s governance and contribute to its sound growth and development. |

| Takayoshi Meiga | 13 times* | ― | We believe that Takayoshi Meiga can use his wide-ranging experience and technical expertise in the steel and ordinary steel electric furnace industries, as well as his experience in appropriately overseeing all aspects of business execution as a company manager, to contribute to the sophistication of the Company’s core technologies and the creation of new value and solutions. |

| Tatsufumi Sakai | (New appointment) | ― | We believe that Tatsufumi Sakai can use his wide-ranging expertise in financial operations, such as in management planning, investing banking, and international operations, as well as his abundant management experience, including as a Group CEO, to provide beneficial advice. From a standpoint independent to business execution, we also look forward to him maintaining and improving the oversight and checking of conflicts of interest and other management matters. |

| Yoko Waki | 17 times | 15 times | Although Yoko Waki has never been directly involved in corporate management, we believe that she can use her extensive knowledge and insight on corporate law as an attorney and her experience as an outside director of other companies to audit the Company’s management. |

| Hayato Yoshida | 17 times | 15 times | Although Hayato Yoshida has never been directly involved in corporate management, we believe that he can use his abundant experience and advanced expertise in corporate accounting as a certified public accountant, as well as his international experience and other wide-ranging knowledge, to audit the Company’s management. |

- * There have been 13 Board of Director meetings since Takayoshi Meiga became a director of the Company on June 29, 2023

Executive Remuneration

Policy on Decisions

Nippon Soda’s executive remuneration is determined based on a balance of common practices, company performance and employee salaries. A resolution was passed on June 26, 2020, at the 151st Ordinary General Meeting of Shareholders to set the total amount of remuneration for directors (excluding directors who are members of the Audit and Supervisory Committee) and directors who are members of the Audit and Supervisory Committee at no more than ¥350 million and no more than ¥100 million per year, respectively. Moreover, the executive remuneration system was revised at the Board of Directors meeting held on April 22, 2022, and a decision was made to introduce a transfer restricted share remuneration system for Company directors (excluding directors who are members of the Audit and Supervisory Committee, outside directors, and part-time directors; hereinafter “eligible directors”). At the 153rd Ordinary General Meeting of Shareholders held on June 29, 2022, discussions were held and a resolution passed to pay eligible directors a monetary remuneration claim equivalent to the amount to be paid for transfer restricted share through this system. In principle, the total number of the Company’s common shares to be issued or disposed of for the purpose of granting transfer restricted share to eligible directors under this transfer restricted share system shall be up to 30,000 shares per fiscal year. Moreover, the total amount of monetary remuneration to be paid for the purpose of granting transfer restricted share shall be up to 60 million yen per year (however, this does not include the salary for directors concurrently serving as employees).

Director remuneration shall be determined within the limits of the total amount of remuneration approved by the General Meeting of Shareholders, and shall be discussed and decided by the Board of Directors based on the advice, recommendations and findings of the Nomination and Remuneration Advisory Committee. The Board of Directors entrusts decisions regarding directors’ basic remuneration, as well as directors’ (excluding outside directors) performance-linked remuneration, evaluation remuneration, and share-based remuneration, to the representative director and president. We believe that the representative directors are most suited to evaluating the departments that each director is responsible for while considering overall business performance and other factors. The appropriateness of decisions made regarding remuneration are confirmed in advance by the Nomination and Remuneration Advisory Committee.

Executive remuneration for FY 2024 was discussed by the Nomination and Remuneration Advisory Committee on June 19, 2023. Based on their findings, the policy for determining individual director remuneration (excluding outside directors, part-time directors, and directors who are members of the Audit and Supervisory Committee) was determined at the Board of Directors’ meeting on June 29, 2023.

Following confirmation that methods for determining remuneration were in line with the decision policy, that the resulting remuneration conformed to the decision policy discussed at the Board of Directors’ meeting, and that the findings of the Nomination and Remuneration Advisory Committee were respected, we have determined that individual director remuneration for FY 2024 is in line with the decision policy.

As stipulated in the Articles of Incorporation, the number of directors (excluding those who are members of the Audit and Supervisory Committee) is limited to ten, and the number of directors who are members of the Audit and Supervisory Committee is limited to five.

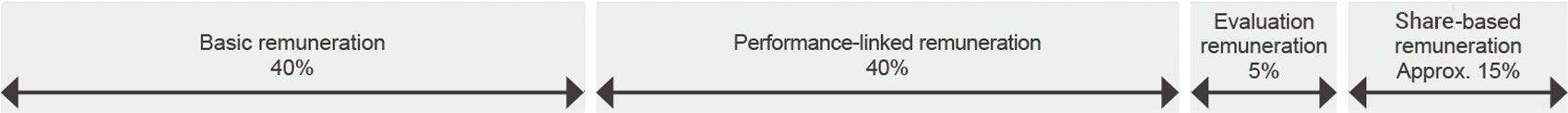

Remuneration System

Individual director remuneration consists of (1) basic remuneration, (2) performance-linked remuneration, (3) evaluation remuneration, and (4) share-based remuneration, the ratios of which are shown in the table on the following table (Overview of Decision Policy on Individual Remuneration: (e) Decision policy on ratio of remuneration by type). Note that directors in charge of supervisory functions, such as outside directors, part-time directors, and directors who are members of the Audit and Supervisory Committee are paid only (1) basic remuneration considering their roles.

At Nippon Soda, we have positioned the promotion of CSR activities, including response to climate change, as an important performance indicator. The level of achievement of this target is the basis for our calculations for the evaluation remuneration system, which is designed to provide an incentive for the relevant initiatives. In terms of director responsibilities, in addition to short-term business performance, we prioritize initiatives geared toward medium- to long-term improvements in corporate value and the achievement of a sustainable society, and as such we are enhancing directors’ commitment to these achievements.

Overview of decision policy on individual remuneration (remuneration system)

| a. Decision policy on basic remuneration | The amount is determined based on the role and position of the director. | ||||||

|---|---|---|---|---|---|---|---|

| b. Decision policy on performance-linked remuneration |

Calculated by the following formula, using an index that shows the results and performance of the current fiscal year Policy on decisions (formula) Prior-fiscal year performance-linked remuneration + Adjustment of performance-linked remuneration for the current fiscal year1 + Performance-linked amount for the current fiscal year2

|

||||||

| c. Decision policy on evaluation remuneration | Calculated based on the level of achievement of the targets set by each director at the beginning of the term and evaluations of their business execution. | ||||||

| d. Decision policy on share-based remuneration | In addition to further sharing value with our shareholders, we have introduced a transfer restricted share remuneration system (RS) as an incentive linked to the medium- to long-term improvement of our corporate value. Through this system, a certain quantity of transfer restricted share is granted to each position depending on their roles and responsibilities. | ||||||

| e. Decision policy on ratio of remuneration by type |

Approximate ratios Basic remuneration: Performance-linked remuneration: Evaluation remuneration: Share-based remuneration 40%: 40%: 5%: 15%  |

||||||

| f. Decision policy on period and conditions of remuneration | Fixed monthly remuneration includes basic remuneration, performance-linked remuneration, and evaluation remuneration. For transfer restricted share remuneration, which is non-monetary remuneration, transfer restricted share is granted every year based on an allotment agreement. Transfer restrictions are lifted when an executive retires or resigns from their final position in the Company. | ||||||

| g. Decisions on individual remuneration | Based on decisions by the Board of Directors regarding basic remuneration, performance-linked remuneration, evaluation remuneration, and share-based remuneration, decision-making authority on individual remuneration belongs to the President. To ensure that this authority is appropriately exercised, prior to making a decision on the relevant amount, the President briefs and holds discussions with the Nomination and Remuneration Advisory Committee and seeks their approval. |

Total Amount of Remuneration

| Classification | Total amount of remuneration (Millions of yen) |

Total amount of remuneration by type (Millions of yen) |

Number of eligible persons |

||

|---|---|---|---|---|---|

| Basic remuneration |

Performance- linked remuneration |

Transfer restricted share remuneration |

|||

| Directors (excl. Audit and Supervisory Committee members) [Outside directors] |

228 [31] |

102 [31] |

101 [-] |

24 [-] |

9 [3] |

| Directors (Audit and Supervisory Committee members) [Outside directors] |

48 [22] |

48 [22] |

— [-] |

— [-] |

3 [2] |

| Total [Outside directors] |

276 [53] |

151 [53] |

101 [-] |

24 [-] |

12 [5] |

- Note 1: The above remuneration includes that of two directors (excl. Audit and Supervisory Committee members) who retired on June 29, 2023, due to the expiration of their term of office.

-

Note 2: The above performance-linked remuneration has been calculated using the following formula and indices that show results and achievements from current fiscal year. Prior-fiscal year performance-linked remuneration + Adjustment of performance-linked remuneration for the current fiscal year1 + Performance-linked amount for the current fiscal year2.

1. Adjustment of performance-linked remuneration for the current fiscal year: Calculated based on three indices: (1) Increase/decrease in consolidated net profit for the current fiscal year; (2) Increase/decrease in consolidated ROE; and (3) Increase/decrease ratio in non-consolidated operating profit

2. Performance-linked amount for the current fiscal year: Calculated based on the following formula:

Standard points based on position × Index coefficient for the current fiscal year (%)3 × Prior-fiscal year average share price

3. Index coefficient for the current fiscal year: Determined within a range of 0% to 200% using a matrix table with the two indices below. (1) ROE for the current fiscal year; and (2) Increase/decrease in consolidated operating profit (the amount of increase/decrease in the current fiscal year’s actual results compared with the average of the previous three years)

These indices enable highly accurate measurement of the level to which we have improved our corporate value, something we have committed to in our long-term vision. As such, we have determined that they are appropriate indices to measure the achievements and level of contribution of company executives, and have selected them as indices for performance-linked remuneration.

The performance indicators used in the calculation of performance-linked remuneration, etc., for this fiscal year are based on the following results:

- Increase/decrease in consolidated net profit for the current fiscal year: ¥5,209 million (compared with plan)

- Increase/decrease in consolidated ROE: 1.9 percentage points (compared with plan)

- Increase/decrease ratio in non-consolidated operating profit: 156.7% (compared with plan), 132.2% (compared with the previous year result)

- ROE: 10.3%

- Increase/decrease in consolidated operating profit: ¥6,878 million (the amount of increase/decrease in the current fiscal year’s actual results compared with the average of the previous three years)

- Stock price average for the previous fiscal year: ¥4,242

- Note 3: Five directors (excl. outside directors, part-time directors, and directors who are members of the Audit and Supervisory Committee) are eligible for the transfer restricted share remuneration system.

- Note 4: Of total non-monetary remuneration for directors (excl. members of the Audit and Supervisory Committee and outside directors), transfer restricted share remuneration accounts for ¥24 million.

Effectiveness Assessment of the Board of Directors

At Nippon Soda, to improve the Board of Directors’ decision-making on appropriate execution of duties and to strengthen their supervisory functions, since FY 2016, all directors have been conducting self-assessments in the form of questionnaires every year. We also regularly commission an external organization to conduct interviews and analyze and assess the results. Most recently, these interviews were conducted in FY 2019 and FY 2022. In FY 2024, questionnaires comprising the topics below were given to all directors, including directors who are Audit and Supervisory Committee members. Based on these results, the Board of Directors examined and discussed its understanding of current level of effectiveness.

(Survey topics)

- (1)Board of Directors’ functions (enhancement of discussions on medium- to long-term management strategies and fulfillment of supervisory functions for matters related to nomination and remuneration)

- (2)Board of Directors’ composition and size (number of directors and independent outside director ratio, and level of skill and diversity)

- (3)Operation of the Board of Directors (number of meetings, frequency, time; provision of materials; meeting proceedings, etc.)

- (4)Supervision of auditing functions (Audit and Supervisory Committee members’ and outside directors’ collaboration with auditing bodies, etc.)

- (5)Outside directors’ performance of functions (creation of systems to help outside directors perform their functions, provision of information to outside directors, etc.)

- (6)Relationship with shareholders and investors (systems for dialogue with shareholders and investors, shareholder and investor feedback on Board of Directors, etc.)

As a result, overall, it was confirmed that the Board of Directors was functioning effectively. In terms of strengthening supervisory functions related to nomination and remuneration and enhancing information disclosure for shareholders and investors, both of which were issues in the previous assessment, while there were certain improvements, there was judged to be a need to further strengthen related discussions and initiatives. Moreover, there were also calls for the creation and implementation of programs to strengthen the functions of the Board of Directors, and so moving forward we will continue to promote reforms aimed at strengthening its functions.

We will continue to find ways to improve the operation of the Board of Directors and further enhance its effectiveness.